Gamification for financial education: building resilience through play

18 de Enero de 2023

In a changing world with increasingly uncertain economies, young people are exploring and looking for different types of financial alternatives, using digital wallets and becoming interested in cryptocurrencies. However, the levels of financial literacy within this population vary widely. It is strongly recommended that this type of training be taught and addressed from an early age in schools. This line of action makes it possible to bring the attention of children and young people to the issue, and to develop innovative tools that facilitate their learning. Financial education is a key means to achieve higher levels of inclusion and development.

Skills related to planning and managing personal finances are crucial to achieving a resilient and sustainable well-being. Financial education not only helps to make better decisions about matters such as savings or investments, but also to mitigate and prevent risks that negatively affect the material possibilities of people of having a decent standard of living. This type of literacy also promotes financial inclusion by expanding the skills needed to access and use financial services correctly.

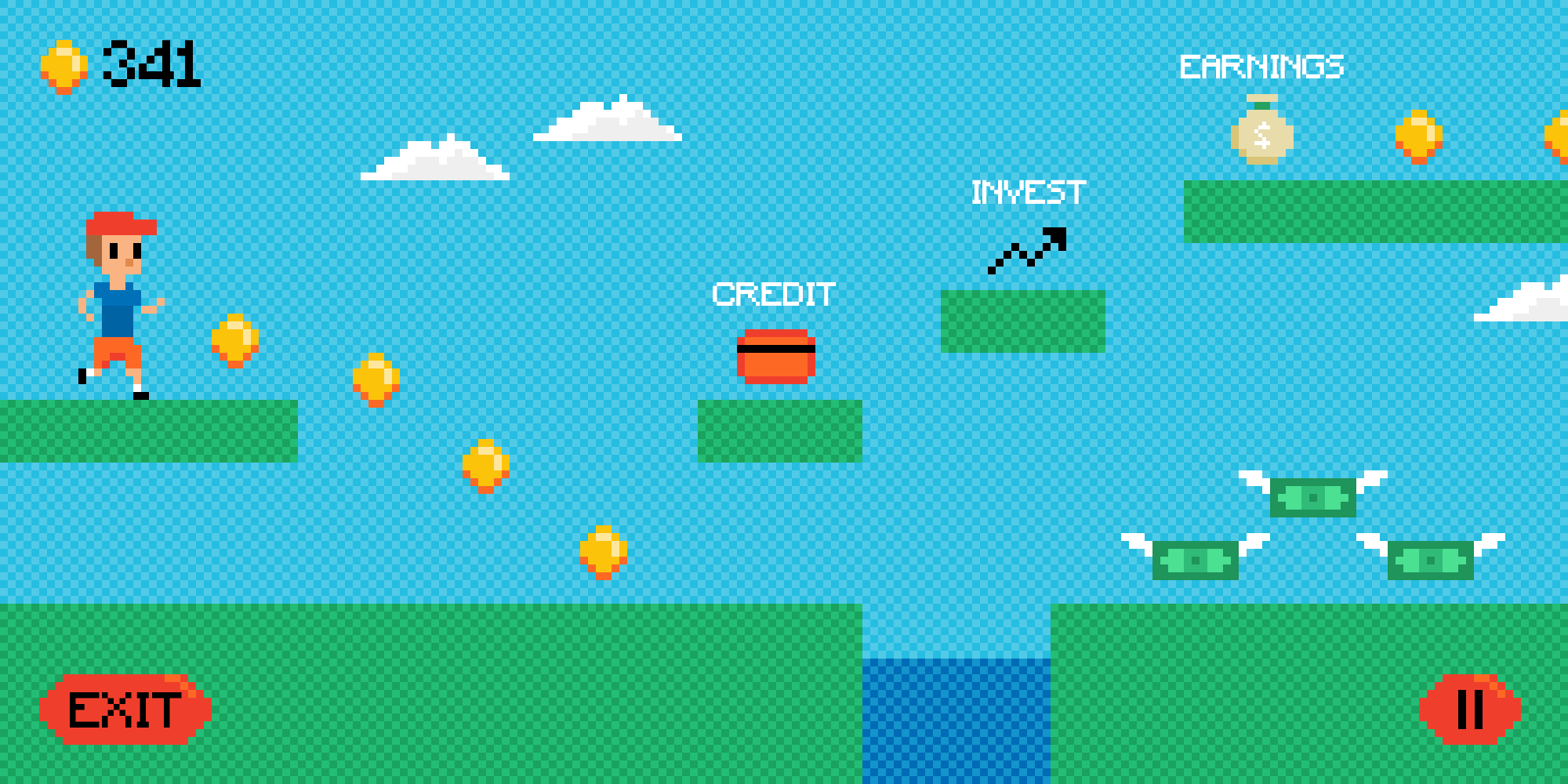

From Co_Lab, Accelerator Lab of UNDP Argentina, we point to gamification, that is, learning through play, as a powerful option to achieve financial literacy. Our work thus far, which includes a work cycle dedicated to financial inclusion, has taught us the importance of experience-based learning with simple and intuitive interactions focused on user experience. Hence, we conclude that combining gamification with apps can be a very powerful means of learning. Play as a teaching strategy encourages the application of knowledge in concrete, real-life situations; Thus, it sets mechanisms in motion that facilitate the internalization and development of skills. We also highlight that the use of mobile phones, as a technological means, could potentially bring forth learning processes for different people across generations, from young people to adults, related to the use of financial tools, particularly those of a digital nature.

Together with Lufindo, we carried out a financial education experience for teenagers based on the use of digital tools and gamification as a teaching strategy.

The experience began with an initial diagnosis of the level of financial literacy of the participants and continued with a series of virtual games sessions, in the “choose your own adventure” format. In other words, the game developed based on the decisions that the users made. These decisions were related to everyday situations, such as saving money to buy a bicycle or deciding what to do when we receive money as a birthday present. Young people were thus put in contact with basic financial concepts, such as inflation, interest or risk diversification.

What lessons did this experience teach us?

Financial literacy in young people. Nearly 60% of the young participants showed basic levels of financial literacy. By breaking down the numbers by gender, we see a slight gap that leaves teenage girls somewhat behind compared to their male counterparts. Therefore, there is an interesting space to think about financial education actions from a gender perspective. This finding falls in line with another recently published document of ours, Women in Network, where the significant barriers that they must face become evident.

Financial behaviors. By using the decisions on how to raise money for a purchase in an inflationary context and what to do with it as a reference, we realized that most of the young people demonstrated that they are capable of identifying basic financial instruments, like fixed term deposits, as tools that could help them mitigate potentially negative phenomena such as inflation. In relation to how to raise the money necessary to meet the purchase goal established by the game, these young participants also showed the ability to decide on various strategies, from choosing a job as a salaried employee, establishing their own business or investing.

Financial education through gamification. The participants valued this type of proposal that goes beyond the traditional presentation of concepts and facilitates learning in a playful way, through concrete and identifiable challenges.

Our experience gave us the opportunity to recognize gamification as an optimal learning strategy for strengthening the financial skills of young people. Every day, they must make financial decisions specific to the moment in life they are going through, such as those related to scholarships or a first job. Currently, they must take on these first financial responsibilities in a context marked by economic instability and a growing offer of digital financial products. All these circumstances challenge us and lead us to reflect on how young people are affected by specific financial learning needs, where gamification appears as an agile and innovative response.

Authors:

Micaela Zapata - UNDP Argentina Accelerator LAB Consultor.

María Verónica Moreno - UNDP Argentina Accelerator LAB Head of Solutions Mapping.

Lorena Moscovich - UNDP Argentina Accelerator LAB Head of Experimentation.

César Zarrabeitia - UNDP Argentina Accelerator LAB Head of Exploration.

Locations

Locations